1 | Why 2025 Is the Year of the Multicurrency Account

Global inflation gaps, rebounding travel demand, and the restless job-hopping of digital nomads make 2025 the point where one-currency banking feels as dated as dial-up. A true multicurrency account (MCA) lets you hold, convert, spend, and receive several currencies inside a single dashboard—skipping retail FX mark-ups that traditional banks still hide in “international” debit cards.

- Travel & remote work: instant in-app card freezes, no-markup ATM withdrawals, and app-level budgeting.

- Cross-border freelancing: local account numbers (IBAN, ACH, BSB, etc.) so clients pay you like a domestic supplier.

- Small import/export firms: one tap to lock a forward rate, a second tap to pay overseas invoices.

2 | How MCAs Actually Work

- Local collecting pockets—virtual account numbers in USD, EUR, GBP, AUD, SGD, etc.

- Mid-market conversions—providers charge a transparent spread (often 0.35 – 1.0 per cent) instead of a 3–6 % card load.

- Global debit card—Mastercard or Visa tied to every pocket; the app decides which currency to draw first.

- Instant peer FX—move JPY to EUR inside the same app at live interbank rates.

- Regulatory ring-fencing—e-money licences or full banking charters determine deposit protection limits. Exiap

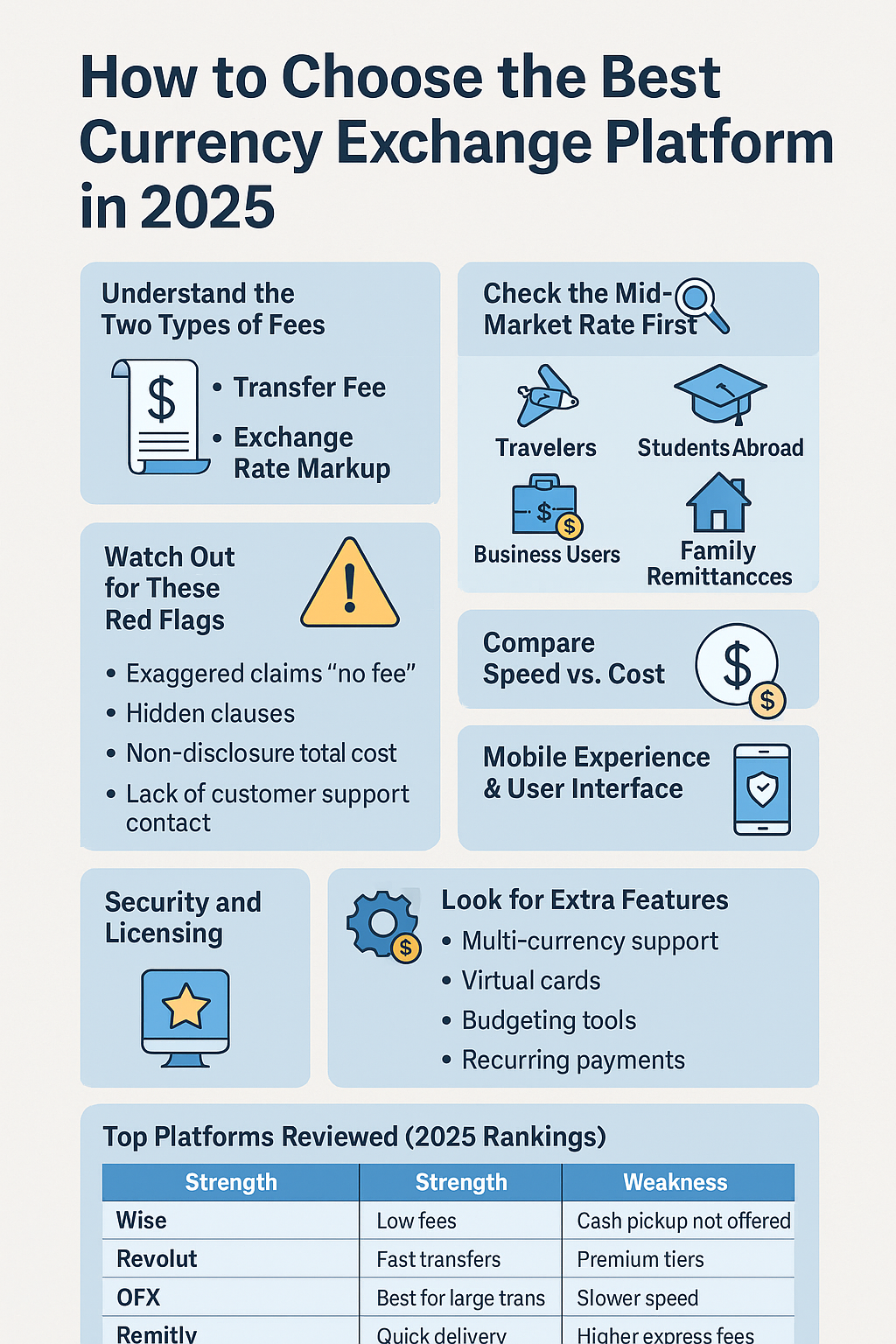

3 | Key Fees & Metrics to Compare

| Metric | Wise | Revolut | HSBC Global Money | Statrys Business | Payoneer |

|—|—|—|—|—|

| Currencies you can hold | 50+ | 30+ | 50+ | 10 | 20+ |

| FX rate | Mid-market + 0.35–1 % | Mid-market + 0–1 % (tiered) | Bank rate | Bank rate + 0–2 % | Mid-market + 0.5–2 % |

| Monthly fee | None | Free/US$9.99/US$16.99 tiers | None (requires HSBC USD acct.) | US$29.95 | None |

| Free ATM | US$100/mo | US$200/mo | HSBC network only | – | – |

| Card network | Visa | Visa | Mastercard | Mastercard | Mastercard |

| Deposit safety | Safeguarded e-money | Bank partner | FDIC-insured sweep | HKMA SVF | FDIC sweep |

(Data updated Apr–May 2025) 포브스ExiapExiap

4 | Top Providers in Detail

Wise – Pure-play FX specialist with 50+ wallet currencies, local banking details in 9, and 0.35 % average FX charge. Card now supports Apple Pay & Google Wallet. Wise

Revolut – Added travel-insurance tier and crypto staking in Feb 2025; FX allowance resets to US$1,000 per month on the free plan. 포브스

HSBC Global Money – In-app upgrade after the bank retired its standalone “Zing” app this year; integrates with any HSBC USD checking account and offers fee-free global transfers between HSBC customers. The Sun

Statrys Business – Hong Kong-regulated SME account: 10 currencies, multi-user approval flows, and a flat 0.5 % FX mark-up. Statrys

Payoneer – Still the choice for marketplace sellers; new 2025 dashboard shows real-time FX exposure by marketplace.

5 | Step-by-Step: How to Open Your MCA

- Pick the licence level you trust (e-money vs. full bank).

- Gather KYC documents – passport, selfie, and (for businesses) incorporation papers.

- Verify faster with e-ID – in 2025 EU/UK e-ID schemes cut onboarding to minutes.

- Order a physical card – most ship globally in under a week; add to mobile wallet the moment your virtual PAN appears.

- Fund cheaply – ACH, SEPA, or local rails; avoid international wire fees on day one.

6 | Minimizing the Last Hidden Fees

- Convert only inside the app after market hours settle; you avoid weekend surcharges.

- Hold till your rate hits a personal trigger (set rate alerts).

- ATM strategy: withdraw larger, less frequent amounts inside the free tier; treat local cash like petty cash.

- Pair with a no-FX credit card for big purchases where merchant protection matters.

7 | Security & Regulation

Reputable MCAs segregate client funds and publish annual audits; Wise and Revolut both joined the UK Travel Rule Alliance in March 2025, making cross-platform transfers safer. Always activate 2FA, freeze cards between trips, and download monthly statements for tax.

8 | Who Benefits Most?

| Profile | Pain Point | MCA Win |

|---|---|---|

| Digital nomad | Freelance income in 3 currencies | Local account numbers; low FX to home base |

| Remote employee | Payroll in USD while living in KRW | Split salary pocket: hold USD, swap just rent money |

| SME importer | Supplier invoices in CNY | Pay directly in CNY without bank’s 4 % spread |

| Frequent traveler | Card fees abroad | Real-rate spending + free ATM allowance |

9 | Future Trends (2025-2028)

- Embedded finance: multicurrency modules baked into travel-booking and freelancer platforms.

- CBDC corridors: Singapore & U-Korea pilot lets MCAs hold tokenised SGD/KRW from Q4 2025.

- Stablecoin top-ups: some providers already let you off-ramp USDC→USD inside the same wallet.

10 | Action Checklist

- Choose a provider with local banking details you’ll actually use.

- Calculate FX you’d have paid last year; target 60-80 % savings.

- Automate rate alerts and monthly statements.

- Re-route salary or client payments into the MCA to build real savings from day one.