The international payment trick that’s draining your wallet without you knowing

Imagine you’re traveling abroad. You swipe your card at a restaurant in Paris, and the payment terminal politely asks:

“Would you like to pay in USD or EUR?”

Out of habit or confusion, you choose USD—your home currency. Seems safer, right?

Wrong.

What just happened is called Dynamic Currency Conversion (DCC), and it’s one of the most deceptive, costly traps in international payments. By selecting to pay in your home currency, you may have unknowingly lost up to 10% on that single transaction.

This guide will break down exactly what DCC is, why it exists, how it impacts your wallet, and most importantly—how to avoid it every time.

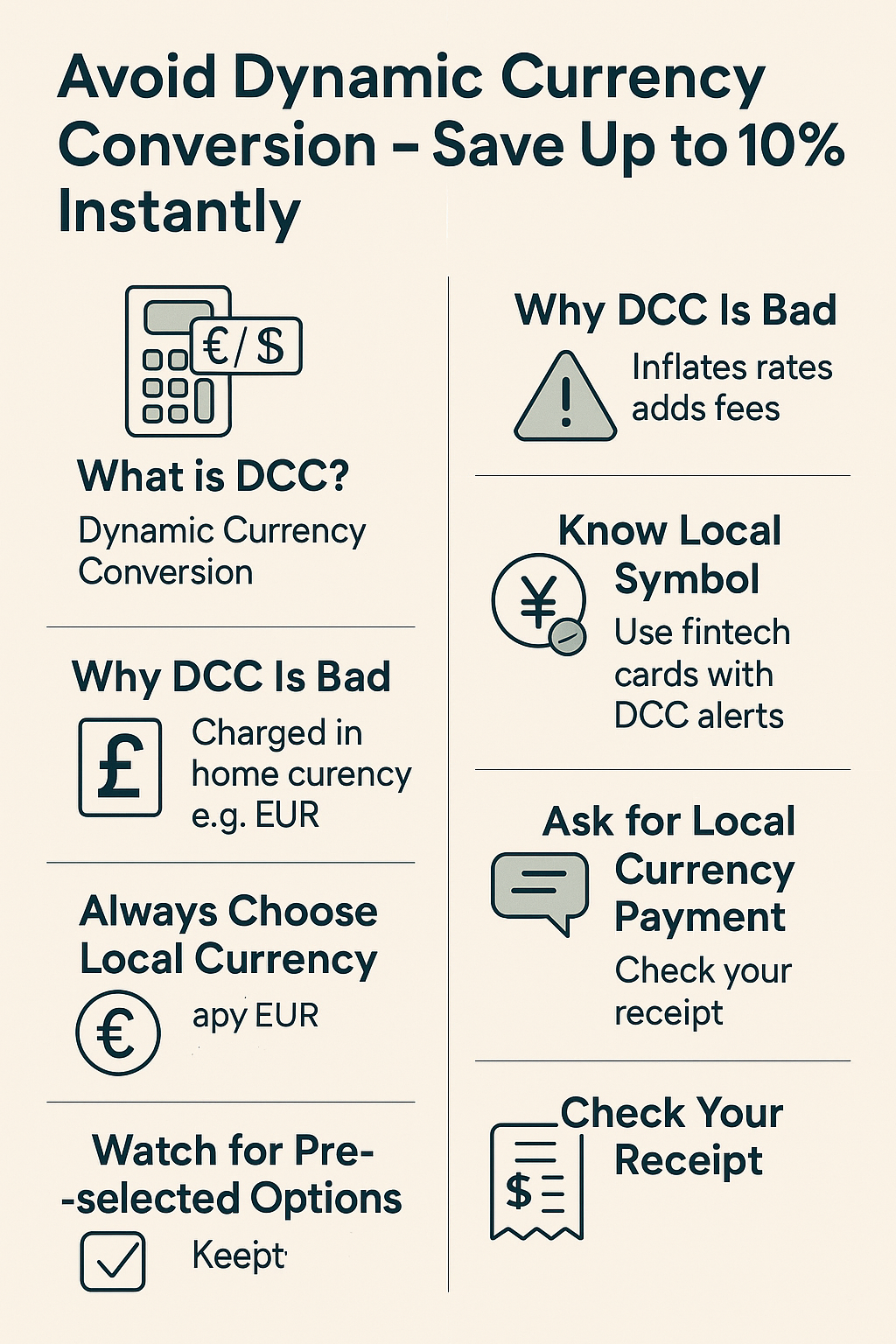

1. What Is Dynamic Currency Conversion (DCC)?

DCC is a service offered at the point of sale (POS) or ATM that allows a foreign cardholder to be charged in their home currency, rather than the local currency of the country they’re in.

While it sounds convenient, DCC is not in your favor. It typically includes:

- An unfavorable exchange rate

- A hidden markup (typically 4–10%)

- Additional service fees

- Lack of transparency

The merchant or ATM provider pockets the difference—and you foot the bill.

2. Why DCC Is So Dangerous

Here’s what makes DCC especially deceptive:

- It’s offered like a favor: “Pay in USD to avoid surprises!”

- It seems safer: you recognize the amount in your own currency.

- It’s often presented as a default or rushed decision.

- The actual cost is never shown clearly on the screen.

Real Case: A traveler in Rome paid $80 USD for a €70 meal using DCC.

Had she paid in euros and let her bank do the conversion, it would’ve cost $74. That’s a $6 loss in one swipe—almost 9%.

3. How DCC Works Behind the Scenes

- When you select to pay in your home currency, the terminal calculates the conversion rate set by the merchant’s provider, not your bank or card network.

- This rate includes a markup designed to maximize profit.

- The provider gives a cut of that profit back to the merchant as an incentive.

So essentially, you’re opting into a bad deal, and someone else is profiting from your decision.

4. When and Where You’ll Encounter DCC

DCC is most commonly encountered in:

- Hotels

- Restaurants

- Airports

- ATMs

- Tourist areas

- Online stores selling internationally

It’s especially prevalent in Europe, Asia, and Latin America, where cross-border card usage is high.

Even contactless or mobile payments (Apple Pay, Google Pay) can trigger DCC prompts if linked to foreign cards.

5. Why Banks and Card Networks Don’t Warn You

Your bank won’t alert you in real time that DCC was used. You’ll only see it in your transaction history—often too late.

Card networks like Visa and Mastercard allow DCC, because it complies with regulations, and technically you’re making a “choice.”

But in reality, that choice is often uninformed, misleading, or rushed.

6. How Much DCC Costs You

Let’s say you spend $2,000 abroad during a trip. If DCC is applied to 50% of your transactions at a 7% markup, you’ve lost:

$70 – $100

That could’ve covered an extra hotel night or two fine meals.

Multiply this over business trips or long-term stays, and it becomes hundreds to thousands of dollars.

7. How to Avoid DCC Like a Pro

Here are your foolproof steps:

Always Choose Local Currency

When the POS asks “pay in home or local currency?”, always select local (e.g., EUR, KRW, JPY).

Watch for Pre-selected Options

Some terminals automatically highlight your home currency. Always double-check before confirming.

Know the Local Currency Symbol

Be familiar with the symbols of local currencies so you can recognize them quickly.

| Country | Currency | Symbol |

|---|---|---|

| EU | Euro | € |

| UK | Pound | £ |

| Korea | Won | ₩ |

| Japan | Yen | ¥ |

| Thailand | Baht | ฿ |

Use Fintech Cards with DCC Alerts

Some fintech cards (like Wise or Revolut) will notify you when DCC is applied and give you the option to contest or cancel.

Train Yourself to Ask Beforehand

When handing over your card, say:

“Please charge me in local currency.”

This avoids automatic DCC at some terminals.

Use ATMs from Known Networks

ATMs operated by major banks often offer better transparency. Avoid “independent” machines in tourist zones.

8. Bonus Tip: Check Your Receipts

After any purchase abroad, check your receipt:

- If it says “Transaction processed in USD” or your home currency: DCC was applied.

- If you see a line like “Exchange rate applied: 1.12 (including markup)”, that’s a red flag.

- Keep all receipts for review—especially for high-value transactions.

9. How to Recover If You Fell for DCC

Unfortunately, DCC charges are rarely reversible. But here’s what you can try:

- Contact your bank or card issuer within 24–48 hours.

- If the receipt shows lack of consent or no disclosure, dispute the charge.

- Consider filing a chargeback if there’s clear evidence of deceptive practice.

- Leave reviews for the merchant to warn other travelers.

10. The Long-Term Strategy: Make It a Habit

Avoiding DCC isn’t about being cheap—it’s about being smart with your money.

Once you train yourself to identify and reject DCC, you’ll avoid losing money on every trip you take, every meal you eat, and every ATM you touch abroad.

In the long run, the savings are significant.

In the short run, you’ll simply stop overpaying.

Conclusion

DCC is the silent killer of global payment efficiency.

Learn to say no to the seemingly polite “Would you like to pay in your currency?”—and say yes to smarter, cleaner, fee-free transactions.