Every year, millions of people lose money without realizing it — simply by exchanging currencies the wrong way.

Whether you’re traveling abroad, sending money to family, or shopping online from another country, you could be paying 4–10% more than you should. Over time, that adds up to hundreds or even thousands of dollars.

In this quick guide, we’ll break down how hidden currency exchange fees work — and most importantly, how you can eliminate them.

1. The Hidden Fees Behind “Zero Commission” Exchange

Many banks or airport kiosks advertise “zero commission” exchanges. But here’s the catch:

They don’t charge a separate fee —

They build the fee into the exchange rate.

Example:

If the real market rate for USD to EUR is 1.10, the bank might offer you 1.05. That’s a 4.5% loss hidden in the rate itself.

2. How Much Are You Actually Losing?

Here’s how it breaks down:

| Amount Exchanged | Real Rate | Bank Rate | Hidden Fee (Loss) |

|---|---|---|---|

| $1,000 | 1.10 | 1.05 | $45 |

| $5,000 | 1.10 | 1.04 | $300+ |

| $10,000 | 1.10 | 1.03 | $700+ |

Over time, especially if you travel or send money abroad frequently, this becomes a serious leak in your finances.

3. What to Avoid (Even If It Looks Convenient)

- Airport exchange booths — worst rates possible

- Cash exchanges at hotels or tourist areas

- Traditional bank international transfers — high fees + bad FX rate

- “Dynamic currency conversion” when paying by card abroad — always choose the local currency, not your home currency

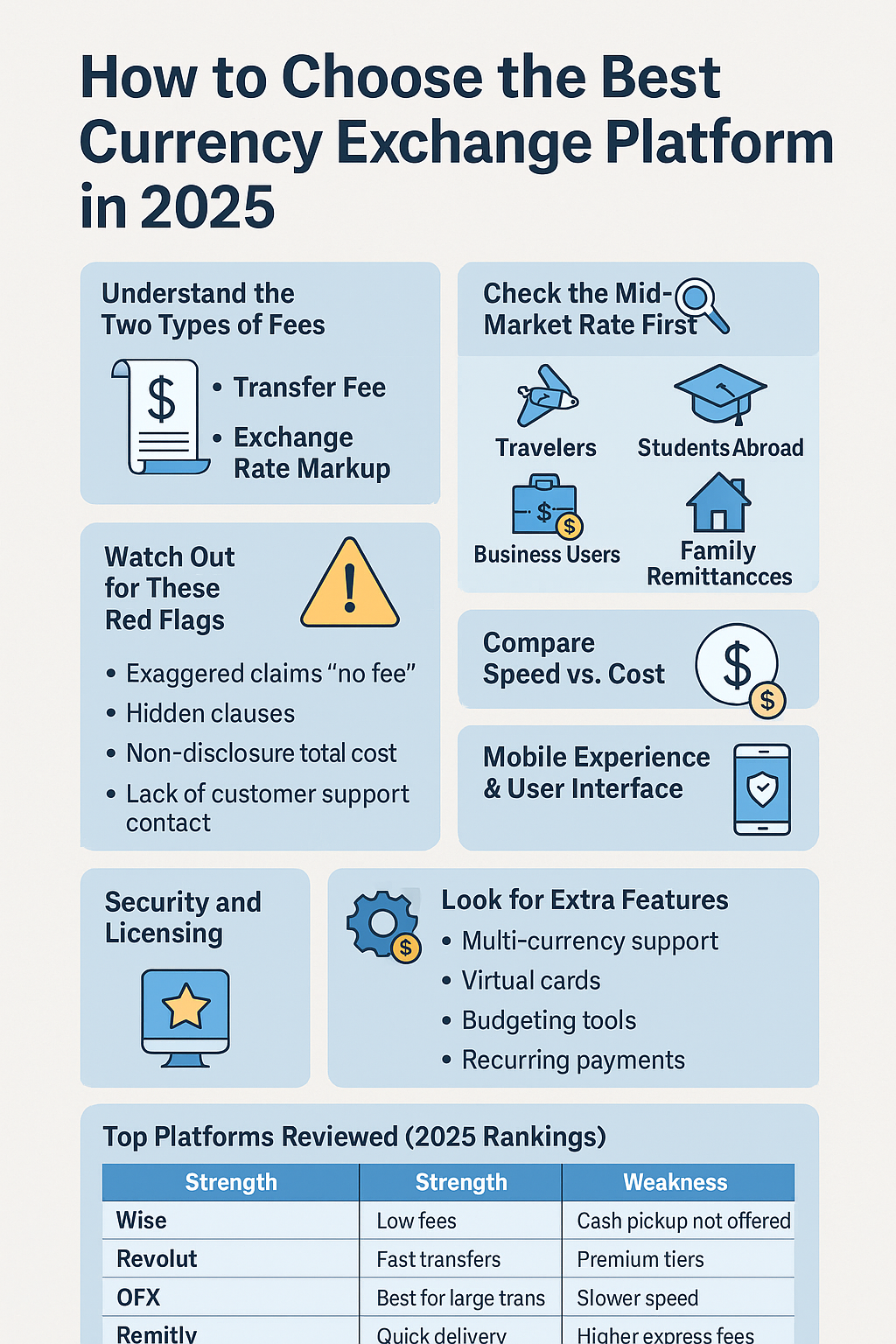

4. Tools That Actually Save You Money

Luckily, 2025 offers plenty of smarter options. These are tested and proven:

Wise (formerly TransferWise)

- Real exchange rate (mid-market)

- Transparent fees (typically 0.5–1%)

- Great for international transfers, paying freelancers, or holding multi-currency balances

Revolut

- Free currency exchange at market rate (within limits)

- Great mobile app for budgeting abroad

- Virtual cards + travel insurance included

Charles Schwab Debit Card (US residents)

- No ATM fees worldwide (refunded monthly)

- Great FX rate (close to market)

- Linked to US checking account

5. Pro Tips to Maximize Value

- Always compare the mid-market rate before making a transaction (Google it)

- Avoid weekends — FX rates worsen due to market closure

- Convert larger amounts at once to minimize per-transaction fees

- If using PayPal internationally, never use their FX rate — link a Wise or Revolut account instead

Conclusion: Stop Leaking Money on Exchange

Currency exchange may seem like a small thing, but it silently chips away at your financial stability. With just a few smart tools, you can protect your money and keep more of what you earn.

Don’t let banks or kiosks eat away your income.

Take control — and exchange wisely.