In today’s volatile economic environment, it’s no longer enough to park money in a savings account and hope for stability. From bank runs and currency collapses to inflation shocks and geopolitical unrest, global crises are reshaping how we think about financial safety.

Amid these uncertainties, a question arises:

Can stablecoins provide real protection in a financial crisis—or do they simply offer digital convenience with hidden risks?

Let’s explore whether stablecoins are a viable hedge or a fragile illusion when markets crash and currencies falter.

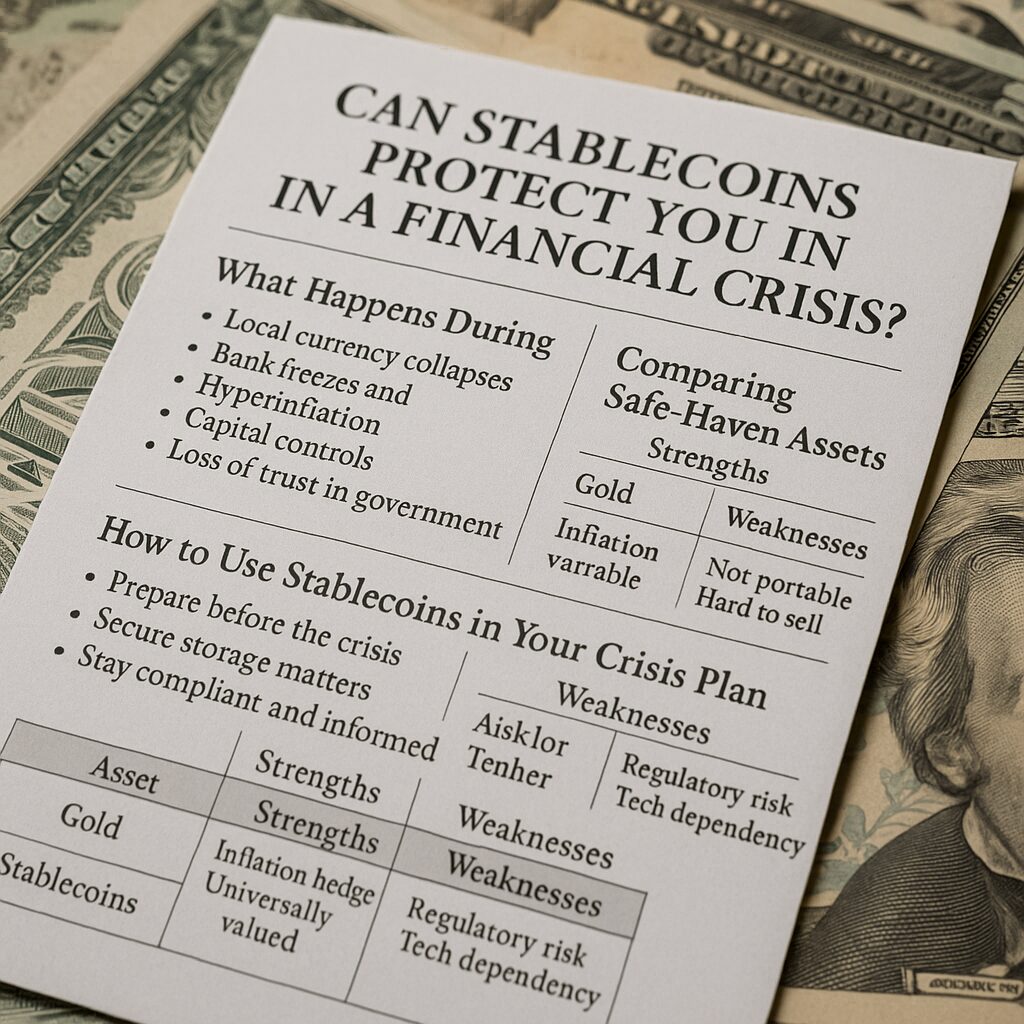

What Happens During a Crisis?

During a financial crisis, people rush to protect their purchasing power. The most common consequences include:

- Local currency collapses (e.g., Argentina, Venezuela)

- Bank freezes and withdrawal limits

- Hyperinflation and black markets

- Capital controls restricting foreign exchange

- Loss of trust in government and central banks

In such environments, the ability to move, convert, and preserve value instantly and independently becomes crucial.

The Appeal of Stablecoins in Unstable Times

Stablecoins—digital tokens pegged to fiat currencies like the USD—are emerging as an accessible, mobile, and borderless alternative. Here’s why:

Dollar Exposure Without a U.S. Bank

- Citizens in crisis-hit countries can hold “dollars” without relying on collapsing local institutions

- P2P markets and crypto ATMs make access possible even amid capital controls

24/7 Liquidity and Portability

- Transfers are instant and global

- Assets can be moved without central approval—ideal in emergencies

Access for the Unbanked

- All that’s needed is a smartphone and an internet connection

- Useful in rural areas and countries with failed banking systems

Comparing Stablecoins to Traditional Safe-Haven Assets

| Asset | Strengths | Weaknesses |

|---|---|---|

| Gold | Inflation hedge, universally valued | Not portable, hard to sell in crisis |

| USD | Global reserve, low volatility | Requires banking access, may be frozen |

| Stablecoins | Digital, portable, USD-linked | Regulatory risk, tech dependency |

| Bitcoin | Limited supply, borderless | High volatility, may fall early in crisis |

Stablecoins uniquely offer the stability of USD + the speed and freedom of crypto.

Real Use Cases Around the World

🇹🇷 Turkey

As the lira fell, locals turned to USDT as a substitute for cash. Crypto trading volume surged on local exchanges.

🇳🇬 Nigeria

Government limits on FX and banking access drove a mass adoption of stablecoins for P2P transactions and savings.

🇱🇧 Lebanon

With banks seizing accounts, families began storing wealth in DAI and USDC, using them for remittances and daily needs.

But Are They Really Safe? Risks to Know

Stablecoins come in three main types, each with its own crisis profile:

| Type | Example | Crisis Resilience | Risk |

|---|---|---|---|

| Fiat-backed (centralized) | USDC, TUSD | High, transparent reserves | Exposure to issuer’s jurisdiction |

| Crypto-backed (decentralized) | DAI | Decent, algorithmic stability | Peg breaks possible under stress |

| Algorithmic | UST (failed) | Extremely poor | Do not rely on during crises |

Never trust untested or algorithmic stablecoins in a crisis.

How to Use Stablecoins in Your Crisis Plan

Stablecoins aren’t magic. They must be used strategically to serve as real protection:

Prepare Before the Crisis

- Onboard funds early while exchanges and ramps are functioning normally

- Learn how to use wallets, backup keys, and access coins without relying on one device

Secure Storage Matters

- Use cold wallets or multi-sig solutions to prevent custodial risk

- Avoid keeping large balances on exchanges—especially local ones

Stay Compliant and Informed

- Monitor laws in your country (some ban stablecoin usage or tax it heavily)

- Be aware of global regulatory changes affecting USDC, Tether, etc.

Crisis Simulation: What Could Go Wrong?

Let’s imagine a scenario where a financial collapse hits your region:

- Bank withdrawals limited to $50/day

- Local currency loses 30% value in a month

- Stock market suspended

- International wires blocked

If you held USDC in a mobile wallet:

- You could instantly convert to a more stable form of USD

- Pay someone directly or send money to family abroad

- Retain digital liquidity while others wait in ATM lines

But if your wallet seed was lost, your funds could be gone.

If your stablecoin was an algorithmic one, it might collapse entirely.

Verdict: Are Stablecoins a Real Hedge in Crisis?

Yes—but only if used correctly.

They combine some of the strongest crisis-resilient traits:

Liquidity

Speed

Global Access

USD Peg

But they also carry unique risks:

Dependence on digital infrastructure

Platform-specific vulnerability

Regulatory gray zones

If you view them as one layer in a diversified emergency strategy—not your only defense—stablecoins can play a powerful role in safeguarding your financial future.