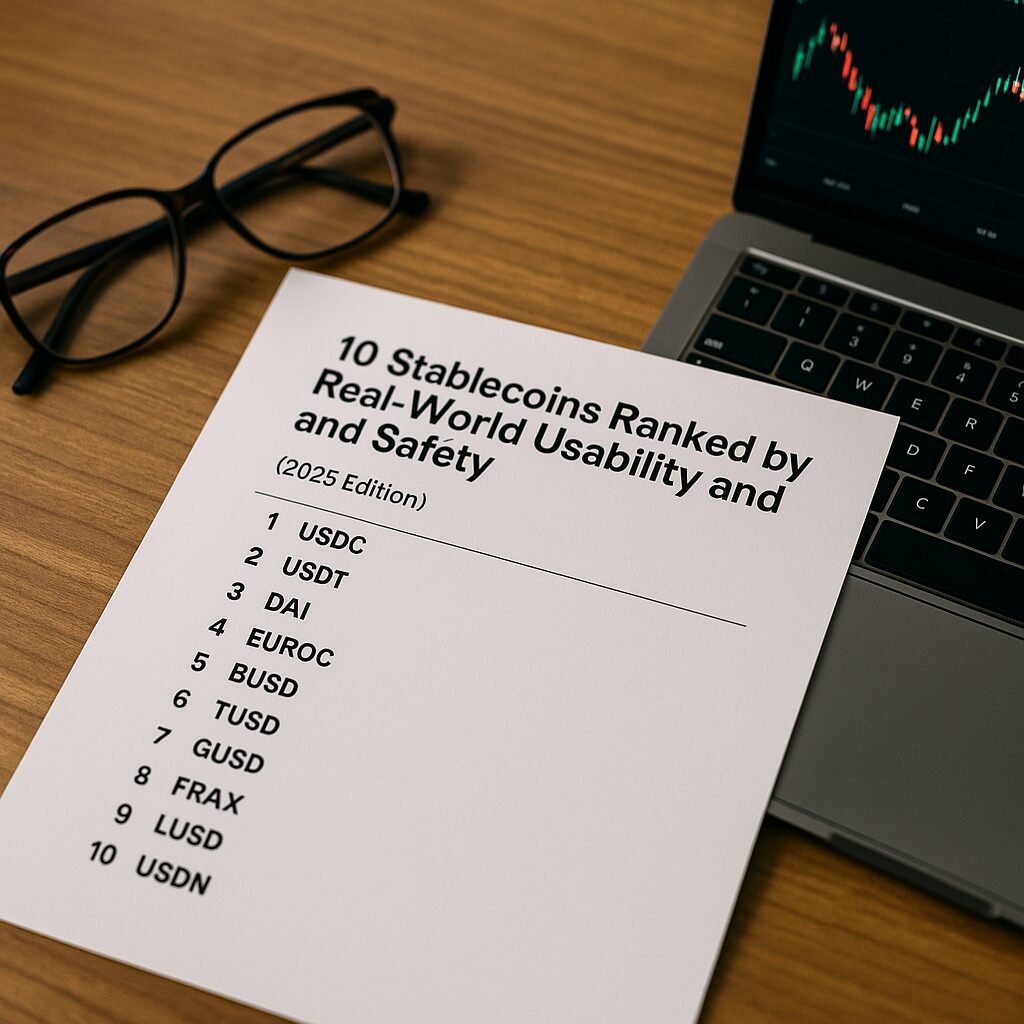

Not All Stablecoins Are Created Equal

Let’s break down which ones are truly usable—and safe—in the real world.

Why “Usability” Matters More Than Hype

Everyone talks about market cap.

Everyone ranks stablecoins by trading volume.

But if you’re an everyday user—trying to send money abroad, earn yield, or save in digital dollars—you care more about:

- Can I use it easily?

- Is it trusted across borders?

- Does it survive volatility and regulation?

This guide ranks 10 major stablecoins based not on hype, but on real-world usability and safety.

We evaluated each stablecoin on:

- Legal transparency & audits

- Adoption by platforms and wallets

- Redemption guarantees & liquidity

- Stability during market stress

Let’s begin the countdown.

#1: USDC (USD Coin)

Best For: Regulated use, global reliability

- Issuer: Circle (U.S.-based)

- Backed by: Cash and short-term U.S. treasuries

- Audit: Monthly attestations by Grant Thornton

- Used by: Coinbase, Stripe, Visa, Shopify

Why It’s #1:

USDC is the most trusted stablecoin for businesses and institutions.

It’s fully redeemable, U.S.-regulated, and globally recognized.

Great for: Payroll, cross-border transfers, long-term savings

Caution: May be restricted in certain countries due to U.S. origin

#2: USDT (Tether)

Best For: Global trading liquidity

- Issuer: Tether Limited

- Backed by: A mix of cash, commercial paper, gold, and other reserves

- Audit: Regular transparency reports (but not full audits)

- Used by: Binance, Huobi, most exchanges

Why It’s Still Strong:

Despite criticism, USDT powers most global crypto volume.

It’s accepted everywhere, and often acts as the “default dollar” in crypto.

Great for: Trading, DeFi, quick liquidity

Caution: History of inconsistent reserves and legal controversies

#3: DAI

Best For: Decentralized finance (DeFi)

- Issuer: MakerDAO (decentralized governance)

- Backed by: Collateralized crypto (ETH, USDC, WBTC)

- Audit: Fully on-chain and transparent

- Used by: Aave, Curve, Compound

Why It Matters:

DAI is the most decentralized stablecoin—it doesn’t rely on banks or governments.

In turbulent times, it proves its value.

Great for: DeFi users, those avoiding centralized control

Caution: Can become unstable if crypto collateral drops sharply

#4: EUROC (Euro Coin)

Best For: European users and businesses

- Issuer: Circle (same as USDC)

- Backed by: Euro-denominated reserves

- Audit: Monthly attestations

- Used by: DeFi protocols, EU crypto startups

Why It’s Useful:

EUROC brings stable euro exposure to crypto, which is rare and valuable for European investors and businesses.

Great for: EU-based saving, EUR settlements

Caution: Liquidity still smaller than dollar-based stablecoins

#5: BUSD (Binance USD)

Best For: Binance ecosystem users

- Issuer: Paxos (regulated in NY)

- Backed by: 100% cash-equivalent reserves

- Audit: Monthly by Withum

- Used by: Binance, PancakeSwap, BNB Chain

Why It’s Falling:

In early 2023, regulators pressured Paxos to stop minting BUSD, leading to its decline in market share.

Great for: Binance loyalty users (short term)

Caution: Being phased out—not ideal for long-term holding

#6: TUSD (TrueUSD)

Best For: Transparent reserve visibility

- Issuer: Techteryx

- Backed by: Fiat reserves verified via real-time attestations

- Audit: Partnership with Armanino

- Used by: Tron ecosystem, Poloniex, DeFi protocols

Why It Stands Out:

TUSD offers live reserve verification, rare in the industry.

Great for: Yield strategies, on-chain transparency

Caution: Ecosystem is smaller, limited liquidity compared to giants

#7: GUSD (Gemini Dollar)

Best For: U.S. regulated crypto savings

- Issuer: Gemini Trust Company

- Backed by: U.S. dollars in FDIC-insured banks

- Audit: Monthly reports

- Used by: Gemini Earn (before closure), BlockFi, trading platforms

Why It’s Relevant:

GUSD once fueled major CeFi interest products.

Though usage dropped, compliance-first structure makes it attractive to some institutions.

Great for: U.S.-based, conservative users

Caution: Weak adoption globally, low liquidity

#8: FRAX

Best For: Innovative algorithmic hybrids

- Issuer: Frax Finance

- Backed by: Partial collateral + algorithmic mechanisms

- Audit: On-chain proof + independent security audits

- Used by: Curve, Uniswap, DeFi pools

Why It’s Unique:

FRAX offers a hybrid model between full backing and algorithmic design.

Great for: DeFi experiments, short-term trading

Caution: Algorithmic models are riskier than fiat-backed coins

#9: LUSD (Liquity USD)

Best For: Hardcore decentralization believers

- Issuer: Liquity Protocol (fully autonomous)

- Backed by: ETH only, with zero governance

- Audit: Protocol-level audits, fully decentralized

- Used by: Ethereum power users, niche protocols

Why It Deserves Attention:

LUSD is one of the few truly censorship-resistant stablecoins.

No admin keys, no fiat dependency.

Great for: Crypto purists, long-term hedging against state control

aution: Niche use, low liquidity, less adoption

#10: USDN (Neutrino USD) – Caution Zone

Best For: (No longer recommended)

- Issuer: Waves protocol

- Backed by: WAVES crypto and algorithm

- Audit: Limited

- Used by: Mostly Waves ecosystem

Why It’s Here:

USDN lost its peg in 2022-2023.

While it has tried to recover, market trust remains broken.

Not recommended for serious users.

To evaluate the top 10 stablecoins, we ranked them based on transparency, real-world usability, and stability under pressure. Here’s how they compare:

How We Ranked Them

- USDC earned the highest marks across all categories. It is highly transparent, extremely usable across platforms, and consistently stable, making it the top-ranked stablecoin overall.

- USDT offers outstanding usability and broad acceptance but has limited transparency and moderate stability. It ranks second due to its unmatched global liquidity.

- DAI is highly transparent and decentralized, with good usability and stability. It stands as the third-best option for users who prioritize decentralization.

- EUROC performs well in transparency and usability for euro-based users, but its liquidity and adoption are still growing. It ranks fourth.

- BUSD, once strong, has declined in usage. It maintains high transparency and good stability but limited future usability. We placed it fifth.

- TUSD delivers excellent transparency and decent usability and stability, placing it sixth in our ranking.

- GUSD is fully regulated and transparent but lacks broad adoption and usage, ranking it seventh.

- FRAX introduces a hybrid approach with moderate transparency and usability, though its stability remains a concern. It takes the eighth spot.

- LUSD is favored by decentralization advocates for its strong stability but limited usability and liquidity. It ranks ninth.

- USDN is disqualified due to repeated depegging and loss of market confidence. Its transparency, usability, and stability are all rated poor.

Conclusion: Use the Right Stablecoin for Your Purpose

- Want maximum safety and legitimacy? → Use USDC

- Want maximum trading flexibility? → Use USDT

- Want true decentralization? → Use DAI

- Want to experiment with DeFi? → FRAX or LUSD (with caution)

- Want to avoid risk? → Skip anything without clear reserves or audits

Not every stablecoin deserves your trust.

Choose based on use case—not marketing.