Yes, even if you make just $2,000/month online.

Introduction: Why This Guide Matters for Ordinary People

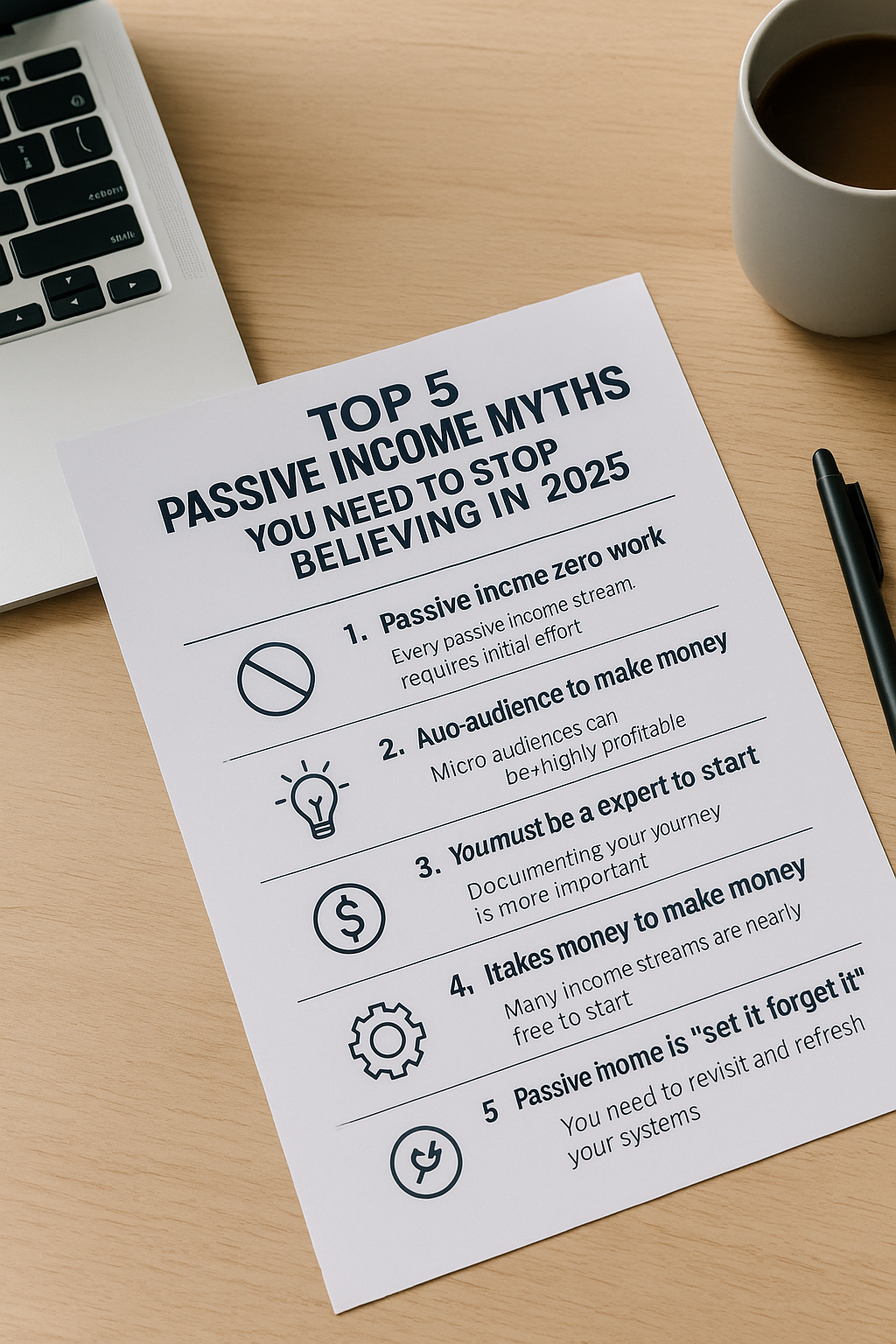

When people hear “zero tax,” they often think of billionaires hiding money in offshore accounts.

But here’s the truth: you don’t need to be rich to use legal strategies to minimize or eliminate your taxes.

If you’re:

- A freelance designer earning $1,500/month

- A remote worker with $2,800/month income

- A digital product seller living in Thailand

…then this guide is for you.

Chapter 1: Understanding the Basics of Global Tax Residency

What is tax residency?

Tax residency is not about your passport — it’s about where governments consider you a resident for tax purposes.

You may become a tax resident if you:

- Stay in a country for 183+ days/year

- Own local property

- Have a family or business registered there

- Or declare yourself resident

If you avoid those criteria, you may legally not be taxed anywhere.

Chapter 2: Three Legal Paths to Zero Taxes (Even on Small Incomes)

1. The 183-Day Rule

- If you don’t stay in any one country for more than 183 days in a year,

most governments won’t consider you a tax resident. - This is the easiest path for nomads who travel frequently.

2. Foreign Earned Income Exclusion (for Americans)

- Allows U.S. citizens to exclude ~$120,000 of foreign income if they:

- Live abroad for 330+ days/year

- OR qualify as a Bona Fide Resident of another country

- Even low-earning freelancers benefit here.

3. Territorial Tax Countries

- Some countries only tax locally-earned income.

- If your clients are abroad, you pay zero local tax.

Countries include:

- Panama

- Georgia

- Malaysia

- Costa Rica

- Paraguay

Chapter 3: Real-Life Example — $2,000/Month Freelancer Strategy

Meet Sarah.

- She’s a Canadian web designer earning $2,000/month on Upwork.

- She travels between Vietnam, Malaysia, and Georgia.

- She spends less than 90 days in each country.

Sarah:

- Is not a tax resident anywhere (183-day rule)

- Uses Wise to manage income

- Has no company registered locally

- Doesn’t hold property or dependents

→ She pays zero local income tax

→ She complies legally with all visa rules

→ She doesn’t need to hire a tax lawyer

You can replicate this model.

Chapter 4: The Tools You’ll Need (Simple & Free Options)

| Need | Tool | Purpose |

|---|---|---|

| Online Banking | Wise / Payoneer | Receive and send funds globally |

| Invoicing | Xolo Go / Stripe | Issue tax-compliant invoices |

| Insurance | SafetyWing | Global nomad health coverage |

| Expense Tracking | Splitwise / Spendee | Manage cross-currency spending |

| Tax Resources | Nomad Capitalist / Nomad Gate | Stay informed on new laws |

Chapter 5: Avoid These Common Mistakes

Staying too long in one place

Even by accident, you can become a tax resident. Use calendar tracking apps.

Using your home-country bank

It may signal tax ties or raise audit flags.

Mixing personal and business funds

Keep everything separate for legal clarity.

Thinking “low income = no audit”

Audits don’t only target the rich. Always keep records.

Chapter 6: Digital Nomad Visas and Low-Tax Residency Programs

More countries now welcome nomads officially:

| Country | Visa Name | Minimum Income |

|---|---|---|

| Portugal | D7 Visa | ~$800/month |

| Georgia | Remotely from Georgia | $0 (no min) |

| Costa Rica | Digital Nomad Visa | $3,000/month |

| Panama | Short Stay Visa | $1,000/month |

These visas give legal status, which helps you prove non-residency elsewhere.

Chapter 7: Frequently Asked Questions

Can I live like this on a $1,500/month income?

Absolutely. Many countries have low cost of living and allow legal visa-free stays.

What if I have a family?

Some countries (like Costa Rica and Georgia) allow family visas for nomads.

What if I work part-time remotely?

The rules still apply. It’s about where you earn, not how many hours you work.

Conclusion: You Don’t Have to Be Rich to Be Tax Smart

Living tax-efficiently isn’t cheating — it’s about knowing the rules.

Even if you’re just starting out online, the earlier you set this up,

the more you’ll keep of every dollar you earn.

Still using a high-tax country as your base? You may be giving away 20–40% of your income needlessly.