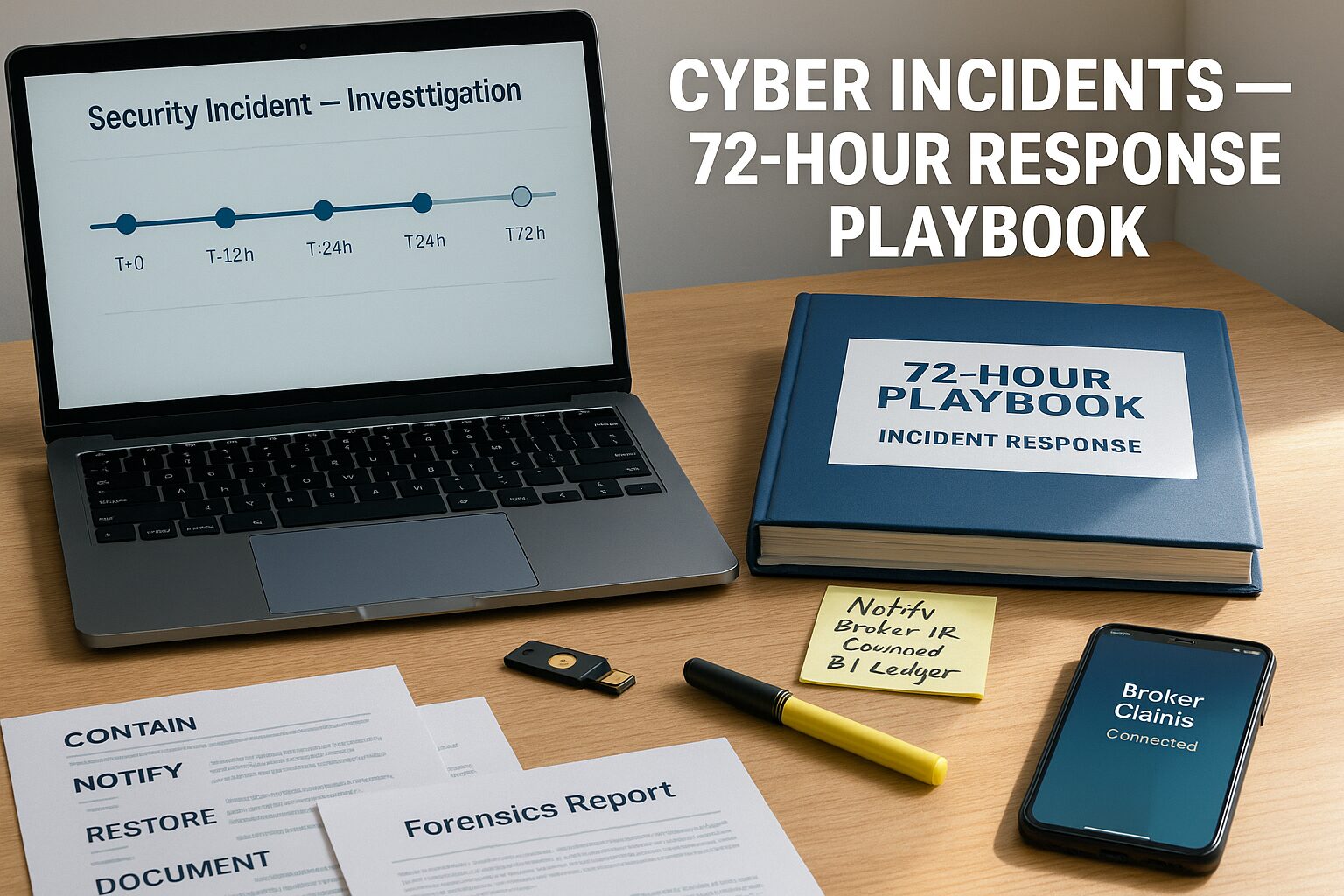

Part 4 — Cyber Incidents & Claims Playbook: A 72-Hour Response for Solo Operators

Why this matters

A breach doesn’t wait for business hours. One misplaced click, one vulnerable plugin, or one leaked token can freeze payouts, cancel campaigns, and derail retainers. The first 72 hours decide whether you stabilize quickly (and get reimbursed) or spiral into weeks of downtime and uninsured losses. This playbook gives solo operators and one-person agencies a minute-by-minute plan, decision trees, claims diary templates, and communications kits to turn chaos into a reimbursable claim. It is practical, insurer-aligned, and written for cross-border freelancers who work with cloud tools and client data.

Not legal advice. Your counsel and broker lead on regulatory notices and sanctions. This guide shows you what to do and what to document so your cyber policy actually responds.

1) Incident Types You Must Recognize (So You Don’t Lose Time)

Most freelancers face a small set of high-impact events:

- Account Takeover (ATO): Email, cloud drive, Git, ad account, or payment processor compromised.

- Ransomware / Encryption Event: Files or servers locked; extortion demand.

- Data Exfiltration / Privacy Event: Client data, credentials, or creative assets copied out.

- Malware / Backdoor Implant: Persistent access via infostealer, RAT, or malicious browser extension.

- Business Email Compromise (BEC) / Social Engineering: Fraudulent invoices, payout redirects, gift-card and wire scams.

- Third-Party Dependency Failure: Cloud provider outage or vendor breach causing your downtime (often sub-limited under Dependent BI).

Claimability hint: Many cyber policies require prompt notice, forensics involvement, and documentation (timeline, logs, receipts). If you hesitate, you can lose coverage—act and record.

2) The 72-Hour Response Timeline (Copy This and Tape It Near Your Desk)

T+0 to +30 minutes — Contain & Preserve

- Isolate affected devices/accounts immediately (airplane mode or network disconnect; revoke sessions).

- Freeze changes: stop auto-deleting logs; don’t factory-reset yet.

- Capture evidence: quick screenshots of alerts, ransom notes, unusual logins (include timestamps).

- Switch channels: if email is suspect, move to phone/secure chat with clients and your broker.

Golden rule: Contain first, explain later. Don’t argue with a live attacker via email.

T+30 to +2 hours — Notify Your Response Team

- Broker & Insurer: email/call your claims desk (on your policy). The sooner you open a file, the sooner you get approved vendors (forensics, counsel, PR).

- Forensics Retainer: request an approved incident-response firm; get a case number.

- Legal Counsel (Privacy/Regulatory): ask insurer for panel counsel; they’ll advise on notice thresholds and wording.

- Password & Token Resets: enforce org-wide resets on identity provider (Google/Microsoft), password manager, cloud tools; invalidate API keys and OAuth tokens.

- MFA Everywhere: enforce phishing-resistant MFA where possible; rotate recovery codes.

Insurance alignment: Many policies require you to use panel vendors. Don’t hire random help before your insurer approves.

T+2 to +6 hours — Triage, Inventory, and Backups

- Asset & Data Inventory: list what’s impacted—devices, drives, projects, clients, data types (emails, PII, credentials, creative files).

- Backups Check: verify last known good backups and restore points (test a small sample now).

- IOC Hunt: indicators of compromise (new admins, unknown MFA devices, rogue apps, cron jobs, browser extensions).

- Access Review: remove dormant users; ensure least-privilege scoping for subcontractors.

- Communications Drafts: start templated notices (see §6); don’t send yet without counsel sign-off.

T+6 to +12 hours — Decide, Notify, and Start Restoring

- Ransomware Decision Brief: with forensics and counsel, assess: data exfiltration evidence, backup viability, operational impact, sanctions risk (never pay without legal/insurer clearance).

- Client Notices (Phase 1): if service delivery is impacted, send a non-panic operational notice (“degraded access, recovery underway”).

- Regulatory Assessment: counsel decides if a data-breach notification is required (thresholds differ by jurisdiction).

- Begin Restore: rebuild from clean images/backups; rotate signing keys, webhook secrets, OAuth credentials.

- Harden: enable EDR/antivirus, patch vulnerabilities, disable risky extensions, force browser password purge.

T+12 to +24 hours — Stabilize Ops & Document Loss

- Business Interruption (BI) Ledger: start recording downtime start/end, affected revenue, rescheduling costs, extra expenses (rent a replacement laptop, pay for rush work).

- Payment & Ad Platforms: pre-emptively notify account reps to avoid freezes or policy violations; request fraud holds be lifted after security resets.

- Client Notices (Phase 2): if data exposure is confirmed, send a counsel-approved notice (see templates).

- Claims Diary (v1): write a detailed timeline from T+0 with actions, people, evidence locations (see §4).

T+24 to +48 hours — Close Attack Paths & Prove Controls

- Root Cause Mitigation: patch CVEs, remove compromised plugins, enforce SSO, implement conditional access (geofencing, device trust).

- Credential Hygiene: reset tokens on all CI/CD, VCS, analytics, billing, and ad platforms.

- Vendor Review: audit third-party apps that had access; revoke and re-authorize selectively.

- Public Statement (if needed): short, factual, and insurer-approved; never speculate.

T+48 to +72 hours — Validate, Report, Improve

- Validation Pass: confirm clean scans, backups restored, no suspicious authentications.

- Claims Pack (v1): assemble invoices, BI ledger, forensics reports, counsel letters, and communications copies.

- Lessons Learned: note control gaps; create a 30-day hardening plan (see §7–§8).

- Client Debrief: share the high-level post-incident summary with enterprise clients (shows maturity and reduces churn).

3) Decision Trees You’ll Actually Use

A) “Is This a Notifiable Breach?” (Simplified)

- Was personal data accessed or exfiltrated?

→ Yes: Counsel evaluates thresholds per jurisdiction (client’s customers may dictate venue).

→ No: Continue monitoring; may still notify operationally. - Would notice reduce harm or is it required by contract?

→ If contract/MSA requires notification upon “security incident,” send operational notice anyway. - Are we within mandatory notice windows? (e.g., 72 hours in some regions)

→ Coordinate counsel templates + insurer approval.

Rule: When unsure, notify operational impact first, breach notification only with counsel.

B) Ransomware Decision Tree (Abbreviated)

- Backups intact + no exfiltration → Don’t engage on ransom; restore.

- Backups intact + exfiltration claimed → Forensics validates; legal weighs privacy risk; consider data-deletion attestation only with counsel and insurer.

- Backups destroyed + critical ops down → Legal checks sanctions lists; insurer approves any negotiation vendor; document decision rationale.

- Third-party vendor encrypted → Review contracts; shift to Dependent BI claim if covered.

Never pay without counsel + insurer approval. Sanctions violations can be criminal.

4) Claims Diary & Evidence Pack (Copy/Paste Templates)

A) Claims Diary (keep in a single doc)

- Incident ID: [YYYY-MM-DD-ShortName]

- Point of Contact (You): [Name, phone, email]

- Broker / Claims Desk: [Name, case #]

- Forensics: [Firm, case #]

- Counsel: [Firm, case #]

- Timeline (UTC):

- T+00:05 Alert from [source]. Screenshot:

/evidence/alerts/001.png - T+00:20 Device isolated; Wi-Fi off.

- T+01:05 Broker called; claim opened #[####].

- T+02:15 Org-wide reset; OAuth tokens revoked (list).

- …

- T+00:05 Alert from [source]. Screenshot:

- Systems Affected: [email, drive, repo, CMS, ad account, PSP]

- Data Categories: [internal, client PII, credentials]

- Decisions: [ransom payment stance; notification scope]

- Next Actions: [checklist with owners]

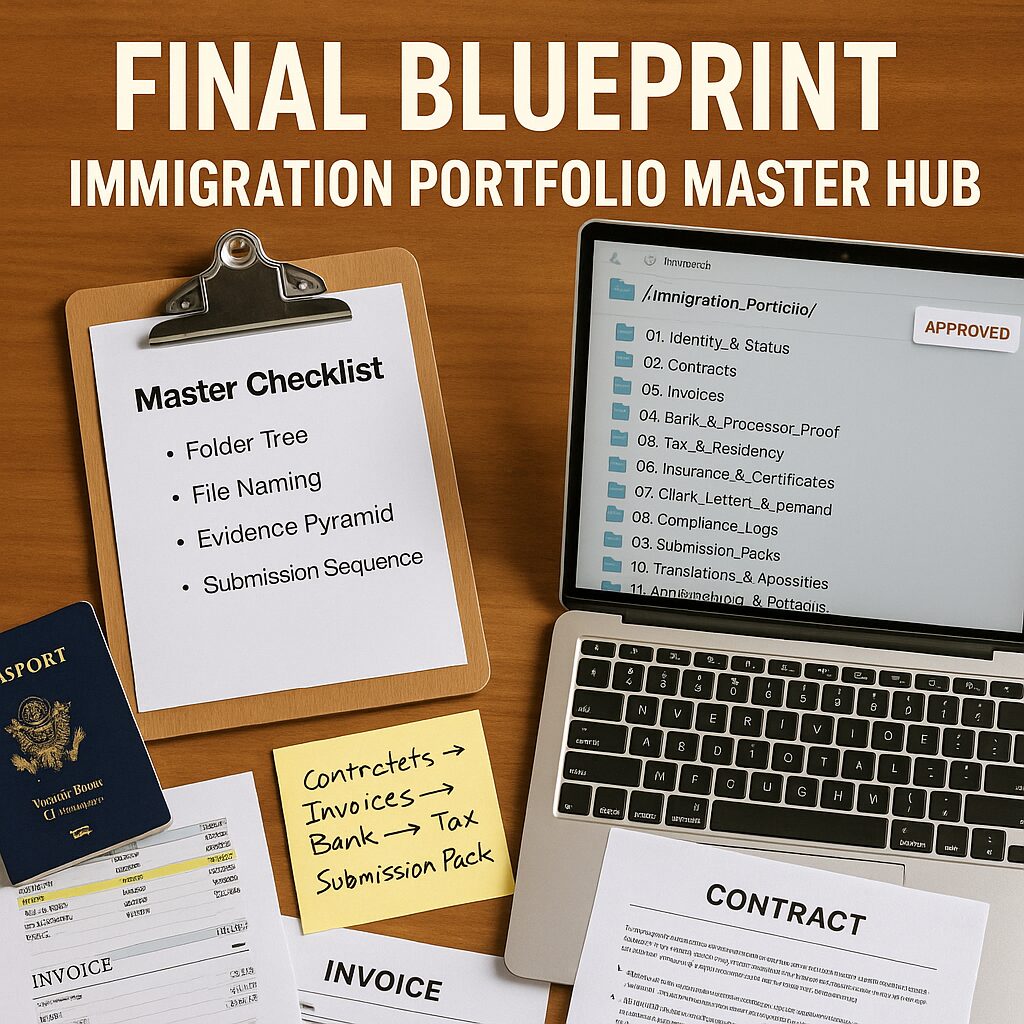

B) Evidence Pack (folder checklist)

/Claims_Pack_[IncidentID]/

01_Timeline_ClaimsDiary.pdf

02_Forensics_InitialFindings.pdf

03_Legal_Assessment_Breach_Notice.pdf

04_BI_Ledger.xlsx

05_Invoices_ExtraExpenses/

06_Communications/

Client_Notice_v1.pdf

Public_Statement.pdf

07_Controls_Proof/

MFA_Policy.pdf

Backup_Report.pdf

EDR_Screens.pdf

08_Contract_Extracts/

Security_Incident_Clauses.pdf

C) Business Interruption (BI) Ledger (columns)

Date|Start Time|End Time|System/Service|Client(s)|Lost Revenue Estimate|Method (baseline calc)|Extra Expense (receipts)|Notes

Baseline methods:- Avg daily revenue (last 60/90 days), seasonality adjusted.

- Contracted day rate × days impacted.

- Ad spend/ROAS models (if marketing ops halted).

5) Communications Kits (Counsel-Ready Drafts)

A) Operational Impact (Phase 1 – no breach confirmed)

Subject: Temporary Service Degradation (Investigation Underway)

Hi [Client Name],

We’re investigating a security incident affecting [system]. Access may be degraded while we restore from clean backups and rotate credentials. We’ve engaged security specialists and will update you within [X] hours. Work product remains recoverable; delivery timelines will be adjusted transparently.

– [Your Name], Point of Contact

B) Breach Notice (Phase 2 – counsel to finalize)

Subject: Security Notice Concerning Your Data

Hi [Client Name],

On [date/time UTC], we identified unauthorized access to [system]. The data potentially involved includes [categories]. We secured the environment, engaged forensics, and notified our insurer and counsel. Out of caution, we recommend [actions]. We will provide updates as the investigation proceeds.

Contact: [Your contact + counsel contact].

– [Your Name]

C) Public Statement (if required)

On [date], we identified and contained a security incident involving [system]. We engaged independent experts and restored operations. We have no evidence of [X] at this time. If our investigation indicates otherwise, we’ll notify affected parties consistent with legal obligations.

Tone: factual, brief, no blame, no speculation.

6) What Insurers Expect (and Often Require)

- Prompt Notice to claims desk and use of approved vendors.

- Evidence Preservation (no wiping before forensics snapshots).

- Security Controls Baseline: MFA on email/SSO, endpoint protection, backups, patching cadence, password manager.

- Cooperation with forensics and counsel.

- Mitigation efforts: credential rotations, takedowns, containment steps.

- Accurate BI Documentation (methodology and receipts).

If your policy lists minimum security requirements (e.g., MFA on all admin accounts), document compliance in your pack.

7) The 10 Controls That Prevent Repeat Incidents (Freelancer Edition)

- SSO + MFA Everywhere (email, password manager, repo, ad platforms, PSPs).

- Password Manager with strong, unique credentials; disable browser-saved passwords.

- Endpoint Protection (EDR) with real-time scanning; auto-updates on.

- 3-2-1 Backups (3 copies, 2 media, 1 offsite), with monthly restore tests.

- Least-Privilege Access and contractor access expiry.

- Token Hygiene (rotate API keys; inventory OAuth grants quarterly).

- Plugin Discipline (audit CMS/plugins; remove abandoned or risky ones).

- Phishing Drills (learn to spot OAuth consent and MFA fatigue attacks).

- Change Logs for admin rights, billing roles, and ad-spend permissions.

- Incident Tabletop every six months (run this 72-hour plan as a drill).

8) Ad/PSP Specifics (Where Freelancers Bleed Cash)

- Ads (Google/Meta/TikTok/LinkedIn):

- Lock admin roles; create separate finance users; enable spending alerts.

- Keep a “clean creative set” to relaunch quickly after compromise.

- If account is suspended after incident, send insurer claim ID + IR vendor letter to policy teams.

- PSPs (Stripe/PayPal/Wise/Revolut):

- Pre-register a security contact; keep KYC fresh to avoid freezes during reviews.

- For BEC events, immediately file a fraud claim with transaction IDs; attach Source-of-Funds letter (from Part 6 of the previous series) if requested.

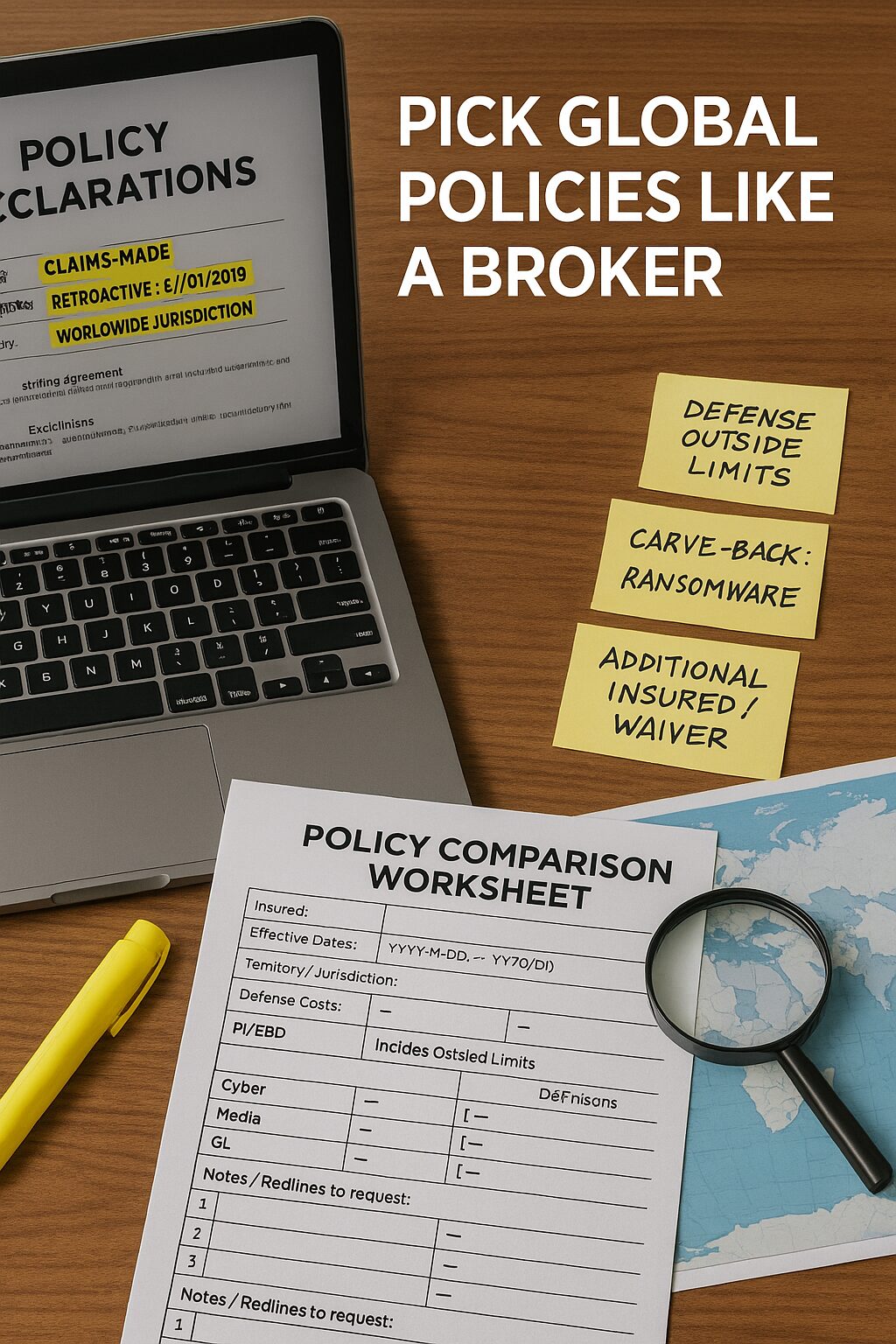

9) Contract Clauses That Save You (and Your Premiums)

- Security Incident Definition & Notice: define “security incident” and “breach,” set realistic notice windows (e.g., “promptly and in any case within 72 hours”).

- Limitation of Liability: cap at fees paid in last 12 months (or a multiple), exclude consequential damages where possible.

- Data Processing Addendum (DPA): match your actual controls; don’t over-promise.

- Subprocessor Disclosure: name critical third parties (cloud, email, PSP).

- Insurance Wording: commit to maintaining PI/Cyber with specified limits; avoid promising occurrence where only claims-made exists.

Present these clauses to insurers at renewal; good contracts often lower premiums.

10) Your “Ready-Before-Bad-Day” Kit (Print, Laminate, Repeat)

- Incident Contact Sheet (broker claims, forensics, counsel, PR, your cell).

- Response Binder (this 72-hour plan + templates).

- Credentials Binder (how to reset SSO, admin accounts, tokens).

- Hardware Go-Bag (spare encrypted laptop, clean USB, FIDO keys, charger).

- Backup & Restore Checklist (with last successful test date).

- COI + Policy Declarations (carriers often ask to see coverage mid-incident).

- Client List with SLAs (who must be notified and how quickly).

Conclusion: Your First 72 Hours Decide Your Next 72 Days

Incidents are inevitable; damage is optional. If you contain fast, notify correctly, document everything, and use insurer-approved experts, you convert a crisis into a controlled project—and a reimbursable claim. Run this playbook once as a tabletop drill. When the real one hits, you’ll be ready, credible, and back to billable work sooner.

English Case List

- Case: One-Person Agency, Ransomware Friday — Isolated in 15 minutes, insurer panel IR engaged at T+70m, restored from clean backups by T+20h, BI ledger reimbursed 6 days of lost production.

- Case: Ad Account Takeover — Admin role hijacked; MFA reset and token purge within 2 hours; platform reinstated after insurer letter; clients retained.

- Case: Social Engineering (BEC) — Fraudulent payout request caught; bank recall filed within 6 hours; policy covered $85k under social engineering sub-limit after documentation.

- Case: Dev Plugin Backdoor — Repo access compromised; secret rotation + dependent BI coverage for client downtime; PI claim avoided by rapid hotfix and counsel-approved comms.

- Case: Data Exfil in Cloud Drive — Forensics confirmed limited scope; counsel drafted notices; no fines; renewal premium held flat due to strong controls evidence.

Next Article Preview

Part 5 — Income Protection & Disability for Solo Operators (Keep the Lights On When You Can’t Work).

Your business can withstand a cyber incident with good process, but who pays you when you’re injured or ill? In the next guide, we’ll translate disability and income-protection jargon into solo-operator reality: waiting periods, own-occupation definitions, benefit durations, exclusions, and quote checklists that keep your retainers alive through a bad month. Skip it and a single medical event could erase a quarter’s profit. Read it and you’ll build a personal safety net that makes your entire insurance stack actually complete.