1. Introduction: The Real-World Dilemma

You’ve saved $100,000 and are ready to invest. But a single question keeps you up at night:

“Should I buy an apartment… or just go with a few ETFs?”

You’re not alone. Every year, thousands of individuals—especially first-time investors—face this exact decision. Real estate has always felt safe and tangible. But ETFs? They seem too digital, too abstract.

Yet in 2025, the lines between these two options have blurred. With housing markets more volatile than ever and ETF innovation exploding, the traditional “safe bet” isn’t so clear anymore.

This guide is not about theory. It’s built for people like you who want clear answers, real-world comparisons, and actionable steps—not lectures.

By the end of this article, you’ll know exactly:

- Which path grows your wealth faster (based on real numbers)

- What the world’s most successful investors are choosing

- How to start today with as little stress as possible

2. Why This Question Matters in 2025

A decade ago, most people would’ve said:

“Buy a property. Rent it out. Watch it grow.”

But 2025 is different.

Let’s break down what’s changed:

Housing Isn’t What It Used to Be

- High interest rates mean higher mortgage costs—even if you have the cash, the returns shrink fast.

- Property taxes and maintenance have surged.

- Vacancy rates in urban areas are unpredictable due to work-from-anywhere trends.

ETFs Are Evolving—Fast

- Monthly dividend ETFs are now designed to mimic rental income, without the landlord headaches.

- New bond + equity hybrid ETFs offer high yield + stability.

- Fees are shrinking. Access is expanding. You can invest in global real estate without owning a single building.

Investor Psychology Has Shifted

- Millennials and Gen Z prefer flexibility and liquidity.

- Many would rather move countries than commit to one house.

In this world, choosing between real estate and ETFs is no longer just a matter of preference—it’s a strategic decision with financial consequences.

3. Case Study: $100,000 Investment – ETF vs Real Estate

Let’s get practical. You have $100,000. What can you realistically do with it?

Option 1: Real Estate Investment

- Type: Small condo in mid-tier city

- Down payment: $100,000 (assuming full cash)

- Monthly rent: $800

- Annual rent: $9,600

- Costs:

- Property tax: $1,800

- Maintenance/insurance: $1,200

- Vacancy (5%): $480

- Net income: $6,120/year

→ 6.1% annual return

Now assume the property appreciates at 3% per year:

- After 5 years: $100,000 → $115,927

- Total ROI (rental + appreciation): ~9.2% annualized

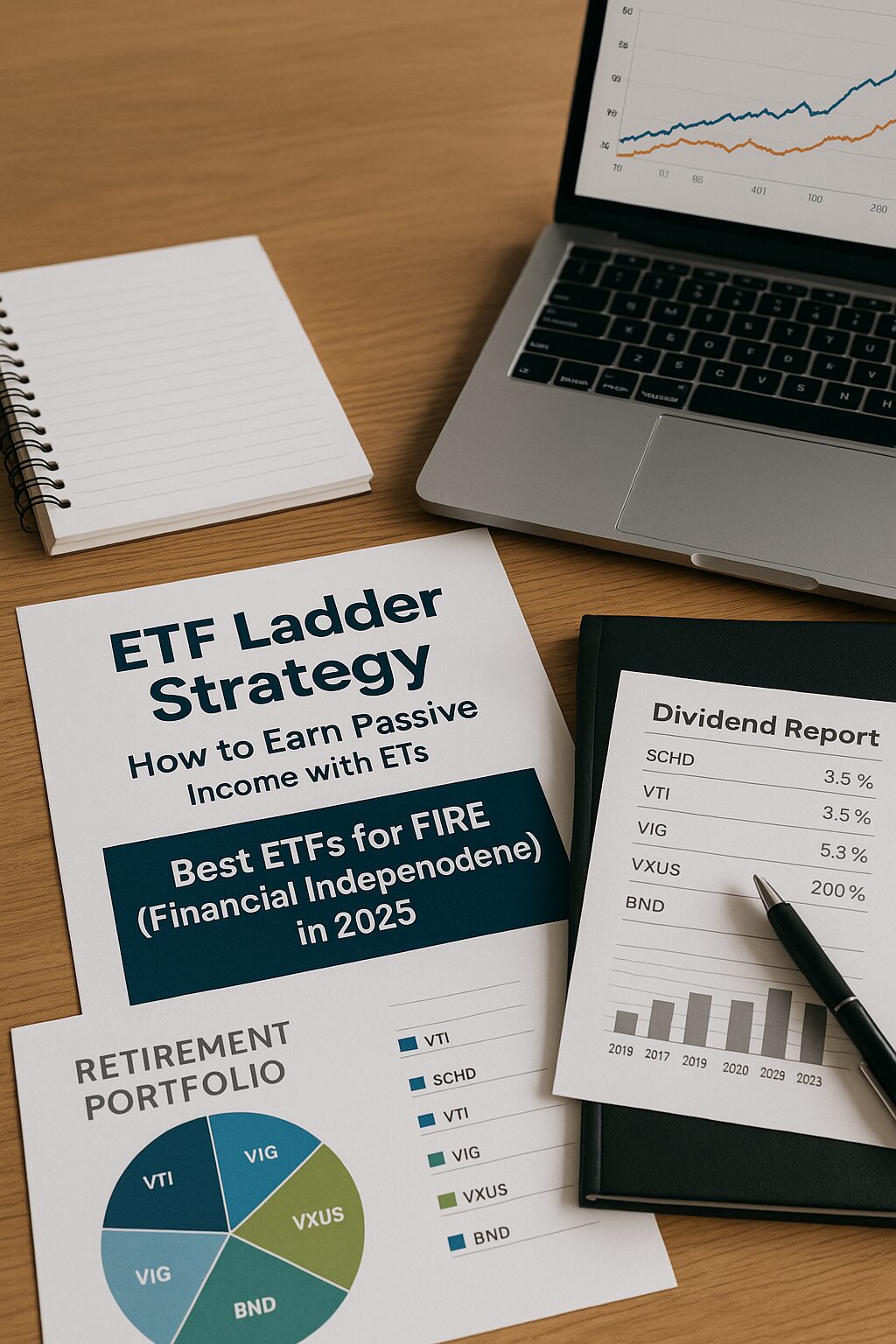

Option 2: Monthly Dividend ETF

Let’s say you invest:

- $50,000 in JEPI (JPMorgan Equity Premium Income ETF, ~9.5% yield)

- $50,000 in SCHD (Schwab Dividend Equity ETF, ~3.5% yield + growth)

Results:

- Estimated average monthly dividends: $500–550/month

- 5-Year Total Growth: ~9–10% annualized

ETF Advantages:

- Fully liquid

- No repairs, no tenants

- Global diversification

- Reinvest dividends for compounding

4. What the Billionaires Are Doing (Buffett, Dalio, Lynch)

You might be thinking,

“Of course billionaires invest differently. That has nothing to do with me.”

But here’s the truth:

Their strategy is surprisingly simple—and totally replicable for small investors.

Warren Buffett: “If You’re Not a Landlord, Don’t Act Like One.”

At Berkshire Hathaway’s annual meeting, Buffett said:

“Most people are better off buying a low-cost index fund and leaving it alone.”

He believes regular investors shouldn’t waste time managing tenants or plumbing problems.

Instead, buy ETFs like VOO or SPY and let time do the work.

Ray Dalio: “Diversification is the Only Free Lunch”

Dalio’s “All-Weather Portfolio” includes:

- Stocks

- Bonds

- Commodities

- Real estate via REIT ETFs like VNQ

He avoids physical properties and still earns income—passively.

Peter Lynch: “Buy What You Understand”

Lynch made his fortune by investing in simple businesses.

His advice:

“You don’t need to be a genius. Just buy what makes sense and hold on.”

And for many people, that’s an ETF.

What This Means for You — Even With $100

Here’s the secret:

They’re not rich because they invest in complex things.

They’re rich because they invest in simple things early—and consistently.

You don’t need $500,000 or a real estate license.

You need:

- A free investing app

- $100 to start

- An ETF like JEPI, QYLD, or VTI

- And the confidence to stay consistent

If billionaires trust ETFs for billions,

you can trust them for your first hundred.

5. Hidden Costs and Risks of Real Estate (That No One Talks About)

On the surface, real estate sounds safe. But here’s what often gets ignored:

1. Maintenance Costs Never Stop

- Leaking pipes, broken AC, mold issues—they all add up.

- Even if you’re not living there, you’re still paying.

2. Property Taxes Can Rise Suddenly

- Many cities reassess values yearly, increasing your tax bill.

- This cuts directly into your rental profit.

3. Vacancy = Zero Income

- One bad month with no tenant? That’s 0% yield.

- You’re still paying insurance, utilities, and taxes.

4. Legal and Tenant Issues

- Evictions can take months—and cost thousands.

- Laws are changing fast. Some favor tenants more than landlords now.

5. Low Liquidity

- Need cash? Selling a home takes months.

- ETFs? You can cash out in minutes.

Bottom line?

Real estate isn’t “bad”—but it’s not nearly as passive as most people assume.

If you want predictable cash flow with minimal headaches, ETFs offer a cleaner, simpler solution.

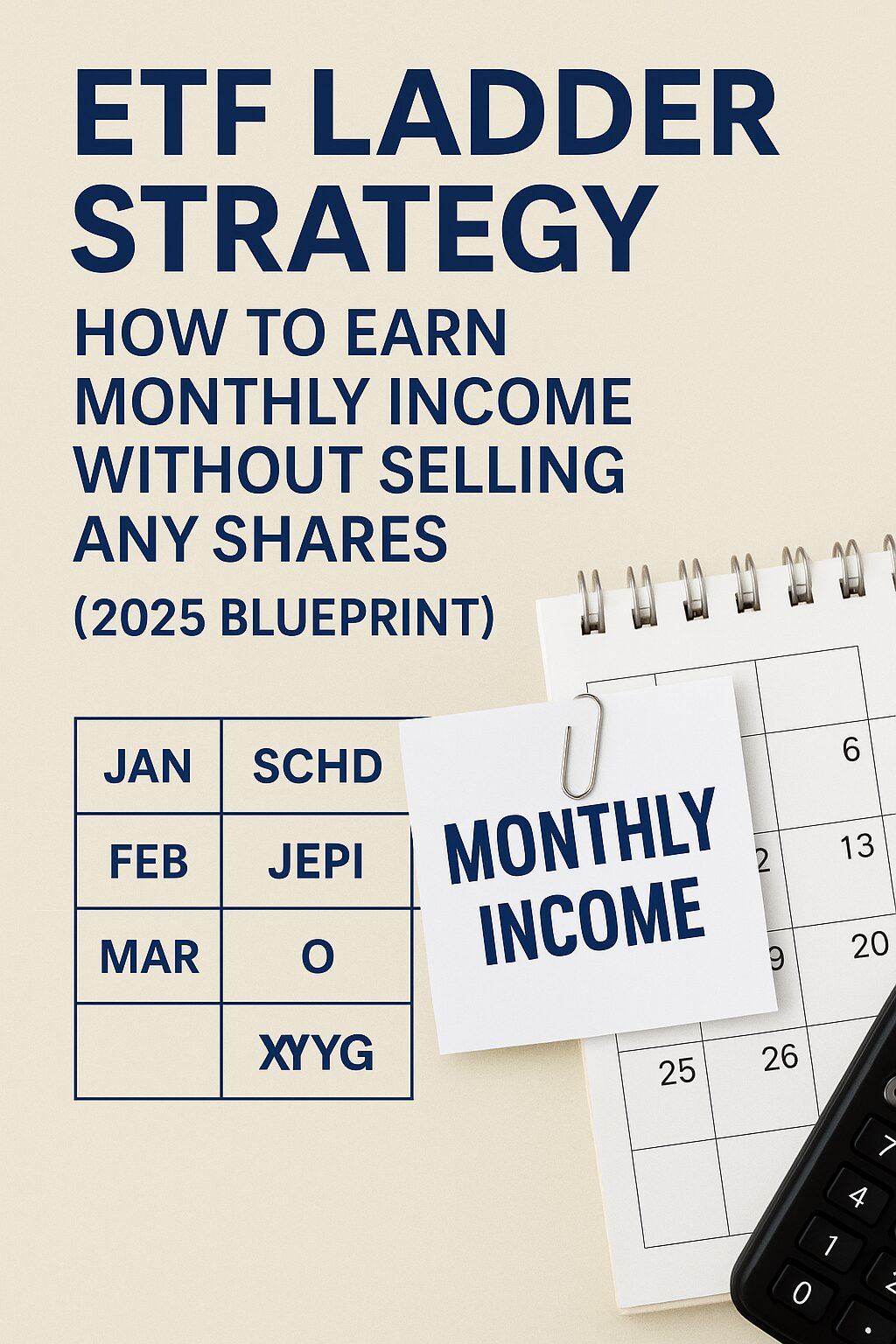

6. Passive Income with ETFs: Monthly Cash Flow Without Tenants

Let’s say you want the feel of owning a rental—

but without the stress.

Enter: Monthly Dividend ETFs.

These are designed to:

- Pay you every month (like rent)

- Require zero management

- Adjust automatically to market changes

What Makes Monthly Dividend ETFs So Powerful?

- They own dozens or hundreds of companies that generate cash

- They bundle that cash and pay you a slice—monthly

- You can reinvest or withdraw as needed

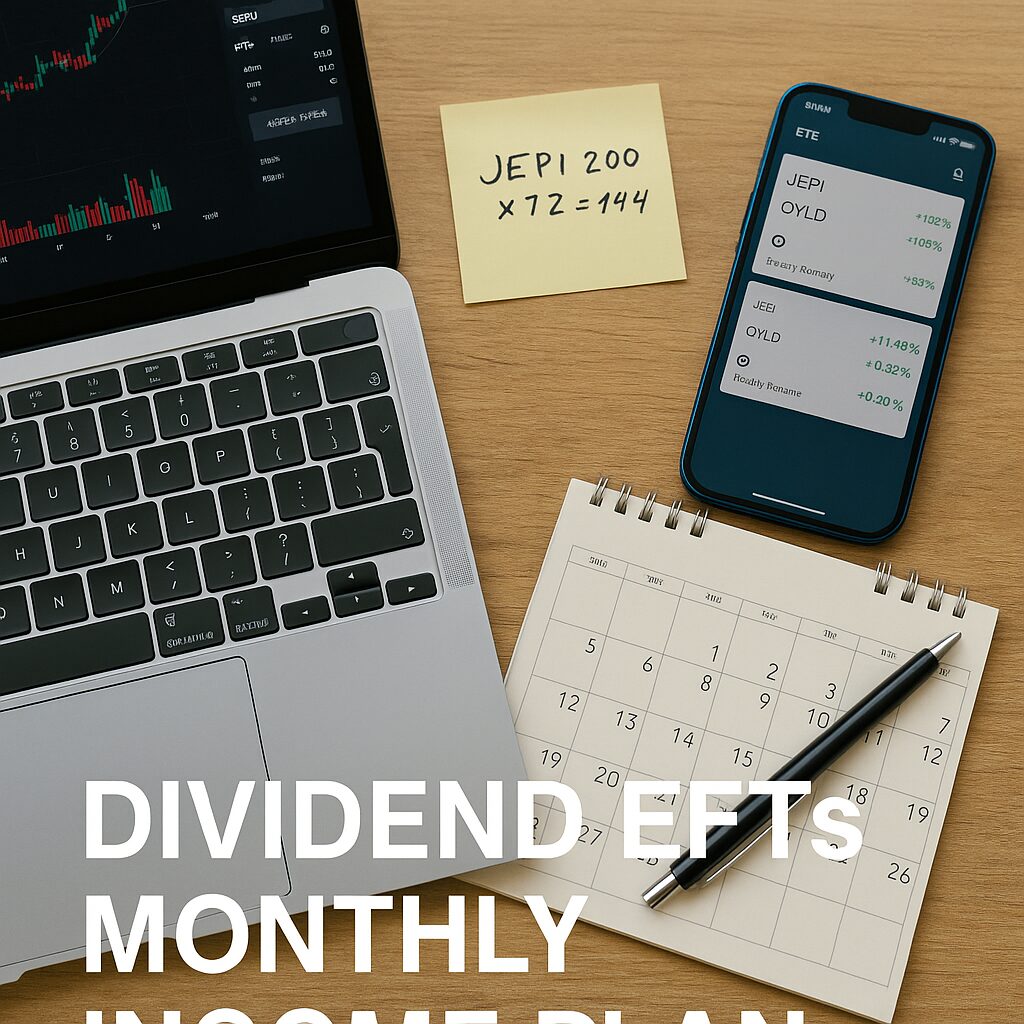

Real Example:

- JEPI: ~9.5% dividend yield

- $10,000 invested = ~$950/year = ~$79/month

- No maintenance. No phone calls. Just auto-pay to your account

It’s like having 10 tenants who always pay on time—and never call for repairs.

7. Step-by-Step: How to Start with Just 2 ETFs in 2025

So how do you actually do this?

Step 1: Open a Free Investment Account

Use platforms like:

- Fidelity

- Charles Schwab

- Webull

- SoFi

They allow zero-commission ETF purchases.

Step 2: Buy These Two ETFs

| ETF | Yield | Purpose |

|---|---|---|

| JEPI | ~9.5% | Monthly cash flow |

| SCHD | ~3.5% | Long-term dividend + capital growth |

→ You can start with just $100 in each.

→ Add more every month if possible.

Step 3: Turn On Dividend Reinvestment (Optional)

Want to grow your income faster?

Turn on DRIP: Dividend Reinvestment Plan.

Every dividend earned is automatically reinvested into buying more ETF shares.

That’s how compounding works.

Step 4: Do Nothing

Seriously. Let time do the work.

Watch your balance grow, your income rise—and your stress fall.

8. Who Should Choose Which? A Personality-Based Recommendation

Still not sure whether real estate or ETFs are right for you?

Here’s a quick test:

| Question | If you say YES… | You should probably: |

|---|---|---|

| Do you enjoy managing things? | YES | Explore real estate |

| Want stress-free monthly income? | YES | Choose ETFs |

| Need cash flexibility? | YES | Choose ETFs |

| Like physical assets you can touch? | YES | Real estate may suit you |

| Hate dealing with repairs or taxes? | YES | Stick with ETFs |

Many investors start with ETFs, build a stable income base,

then branch into real estate later when they have more capital and experience.

9. Final Verdict: Wealth Growth vs Stability – Your Best Bet in 2025

There’s no one-size-fits-all answer.

But if we boil it down:

- Real Estate offers leverage and physical control—but requires time, effort, and big capital.

- ETFs offer simplicity, liquidity, and consistent income—with far less headache.

And remember—you don’t have to choose just one.

In fact, many wealthy investors do both:

- Use ETFs for baseline passive income

- Use real estate for growth when the timing is right

But for 2025, with rising rates, global volatility, and tech-enabled investing…

ETFs are winning more minds—and wallets—than ever before.

10. Next Steps: The ETF Strategy for Monthly Income (Link to next post)

Ready to go deeper?

If you want to build a stable $500/month income using only ETFs,

check out our full blueprint here:

👉 ETF Income Blueprint 2025: Start Here to Build Monthly Passive Income

We’ll show you:

- Which 2 ETFs you need

- How to invest step-by-step

- And how to build income you can actually live on

This is how real freedom starts.

Not with luck. But with a system.